Austin Business Journal shares, "It has been a year of change in Austin for regulations around homebuilding, with many new policies enacted that are meant to boost the supply of residences.

They include new density bonus programs that enable developers to build taller buildings if they include affordable units, as well as modifications to rules governing lot sizes and how many homes can be built on them.

Here is a look at some of the changes enacted in Austin in 2024, in addition to proposals that the City Council may consider soon.

HOME Initiative

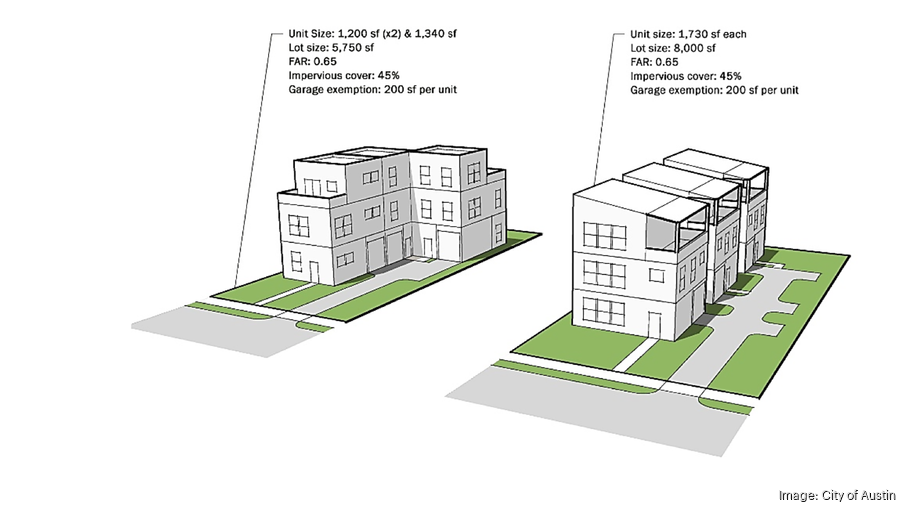

One of the most debated undertakings was the implementation of the HOME Initiative, which altered the rules regarding how many homes can be built on single-family lots and also reduced the minimum required lot size. HOME stands for Home Options for Middle-income Empowerment.

The first phase of the HOME Initiative, approved in late 2023, allows for the construction of up to three homes on single-family lots. Developers have been able to apply to create smaller lot sizes under HOME Phase 1 since February. As of Dec. 2, 237 applications have been received — proposing to build 448 new housing units — and 180 of those applications have been approved, according to the city's website.

The second phase of the HOME Initiative reduces the minimum lot size for single-family zoning from 5,750 square feet to 1,800 square feet, a move proponents contend will allow for smaller and less expensive homes in the city. The HOME Phase 2 regulations were approved in May, although applications to build under them couldn't be submitted citywide until Nov. 16. The city's website doesn’t have data on the number of HOME Phase 2 applications received or approved so far.

Some developers have said that additional revamps to Austin’s regulations will be needed for the HOME Initiative to achieve the goal of adding significantly more housing units to the city — specifically when it comes to the subdivision process. Currently, the regulations don't substantially differentiate between requests to create large subdivisions and requests to create small ones, they said, making it expensive and time-consuming to subdivide small tracts.

The City Council has been mulling changes to its subdivision process for months now, with items related to the effort popping up on meeting agendas since September. During the council's Nov. 21 meeting, a public hearing regarding subdivision changes was delayed until Dec. 12 to provide more time for city staff to incorporate input from the Austin Planning Commission.

DB90 replaces VMU2

Another big change in 2024 was creation of the Density Bonus 90 program. DB90, as it's called, enables mixed-use residential buildings with ground floor retail to rise up to 90 feet — 30 feet higher than otherwise allowed — if certain percentages of the residential units are priced at levels deemed affordable.

The DB90 zoning program was created after a similar program meant to encourage vertical mixed-use density, called VMU2, was struck down by a Travis County judge in 2023. One of the main differences between VMU2 and DB90 is that VMU2 offered by-right entitlements that would automatically allow for a property to be rezoned if it hit certain criteria, while DB90 requires that any property rezoned into the program must be approved by the City Council.

Under DB90, 12% of residential units must be affordable for households earning 80% or less of median family income if the units are owned, or a fee must be paid. For rental properties, 12% of units must be affordable for households earning 60% MFI, or 10% must be affordable for households earning 50% MFI.

While DB90 is still in its early stages, at least 125 acres in the city have been rezoned under the program so far.

Several developers in Austin have said DB90 could prove to be a popular way to add housing, especially in areas just outside the central business district and along major transit corridors. Still, some landowners who have had properties rezoned under DB90 are waiting for what they view as more ideal economic conditions to build new housing.

A new density bonus program soon?

Even with all the work by the city to revamp housing rules this year, more could be done before the new year.

The City Council has another density bonus program under consideration, called DB240, that would increase maximum heights for buildings on properties zoned for commercial highway services, industrial or research and development by 120 feet from current levels and also allow for residential and commercial uses.

If approved, the DB240 changes would allow for buildings in commercial highway services districts and major industrial zones to rise up to 240 feet; for light industrial and industrial park zones to have buildings of up to 180 feet; and for research and development zones to have buildings up to 165 feet.

An ordinance for the DB240 program was set to be voted on at the Nov. 21 council meeting, but it also was delayed until the Dec. 12 meeting to allow for further tweaks. Details of the DB240 program could change in the interim.

The proposed DB240 program has similar guidelines as the DB90 program, in that it rewards developers with taller buildings in exchange for providing affordable housing, or they can pay a fee. But DB240 has height bonuses of 30 feet, 60 feet, and 120 feet — and the taller a building, is the more affordable units it must provide.

Under the current DB240 proposal for buildings that are selling units, the affordability rate is set at 80% MFI. If a building has a 30-foot height bonus, it would need to set aside 10% of the units at affordable rates; for a building that has a 60-foot height bonus, 12% would need to set aside at affordable rates; and for a building with a full 120-foot height bonus,15% would need to be set aside at affordable rates.

For buildings that rent out units, the requirements depend on if the affordability rate is set at 60% MFI or 50% MFI: If a building has a 30-foot bonus, it needs to set aside 10% of its units at the 60% MFI rate or 8% of at the 50% MFI rate; if a building has a 60-foot bonus, it needs to set aside 12% at the 60% MFI rate, or 10% of at the 50% MFI rate; and if a building has a 120-foot bonus, it needs to set aside 15% at the 60% MFI rate or 12% at the 50% MFI rate."

Source: Austin Business Journal

Written by: Sean Hemmersmeier

Published: December 2, 2024

Posted by Grossman & Jones Group on

Leave A Comment