Austin Business Journal writes, "the Austin metro housing market set another sale price record in 2022 — but prices ended the year trending down, another sign of continued cooling and a possible return to more normal conditions.

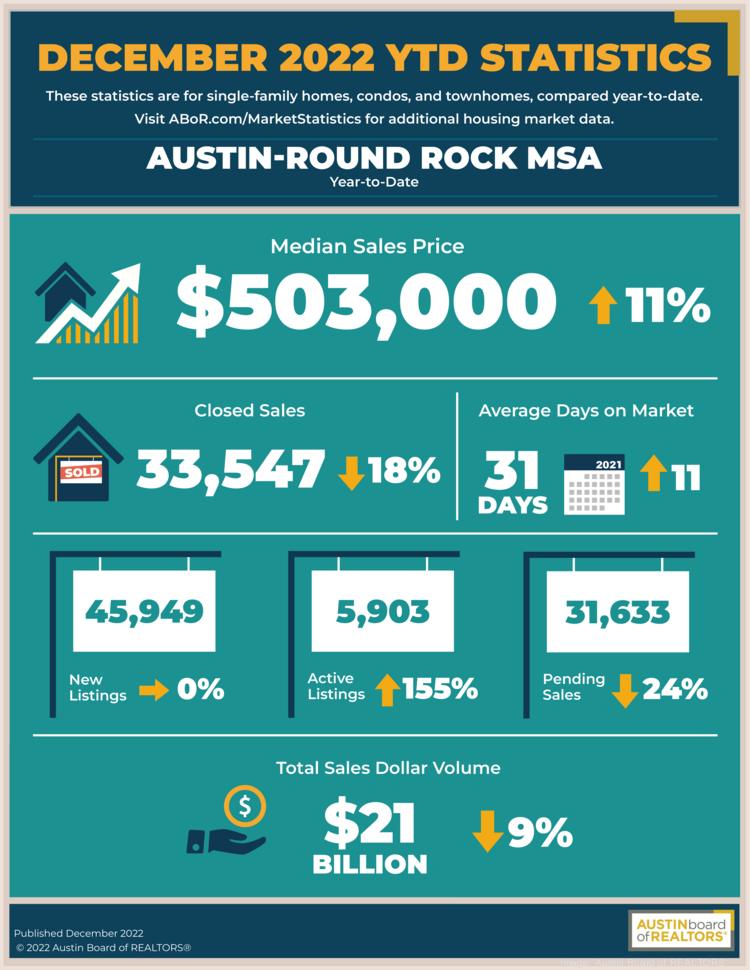

The average median sale price of a home was $503,000 last year, an 11% increase from 2021, according to the latest data from the Austin Board of Realtors.

However, after peaking at $550,000 in April and May, prices have been steadily retreating — hitting $457,426 in December, a 3% year-over-year decrease and nearly $100,000 less than in the spring.

Some of that decline is likely tied to the time of year, as home sales typically slow in the winter months. But even that seasonality would be a welcome return after a couple of crazy years driven by pandemic trends. Zillow recently ranked Austin No. 30 among its hottest housing markets for 2023. That compared with a No. 10 ranking in 2022 and No. 1 in 2021, KXAN News reported.

The Austin area's latest numbers show sellers are beginning to adjust pricing and that the market is stabilizing, said Ashley Jackson, 2023 ABOR president.

The drop in prices can partly be attributed to less competition for homes: in December, closed sales dropped 31% year-over-year to 2,435 and inventory rose to 2.7 months, up from 0.6 months a year earlier.

The 2.7 months of inventory is still far below the six months that indicate a healthy balance between supply and demand, but it is allowing buyers to take their time when house hunting, Jackson said.

"2.7 months is breathing room in the marketplace," she said. "That's a great spot for us to be in, and it's really good news for buyers. That means they’ve got options out there. Things aren’t as hurried and crazy and frenzied and competitive as they were for the past two years. So yeah, we’re stabilizing. It feels like we found our footing.”

Rising interest rates have caused prospective buyers to pump the brakes, Jackson said.

"That's kind of what you can expect, that demand is tracking with interest rate fluctuations knowing that our region still has housing scarcity," she said. "We still struggle, especially, in the city of Austin, to deliver enough housing to the market, which is what has caused such drastic appreciation over the past few years."

Freddie Mac reported Jan. 19 the average weekly rate of a 30-year fixed mortgage was 6.15%, compared with a peak of 7.08% in November.

New builds have helped raise inventory somewhat, Jackson said, although most of the construction is found in the suburbs surrounding Austin. In Hays and Williamson counties, the median sales price was $427,700 and $439,250 last month, respectively. A ZIP code in Leander, which is in Williamson County, was recently ranked the nation's ninth-hottest for the number of homes going under contract within 90 days by Opendoor.

In the city of Austin, median price was $525,250 in December.

Infographic: Austin Board of Realtors has released its latest snapshot of housing trends.

Jackson cautioned sales numbers could climb and inventory could fall again in the spring, when buyers traditionally become more active.

And while these statistics provide some breathing room for buyers, prices are still historically high. Though it might take a few more weeks to sell a home, sellers have "a ton of equity," Jackson said.

Some experts caution that inventory could fall this year as economic constraints prevent homebuilders from quickly delivering the homes the region so drastically needs. Rising construction costs could continue to plague builders in 2023, said Mark Sprague, state director of information capital for Independence Title.

Plus, higher interest rates that dampen buying might convince builders to scale back, Sprague warned. He noted that if rates continue to rise as expected, by summer "buyers will have 72% less buying power than they did at the beginning of 2022."

"Even with the inventory gains made in 2022, our region still needs more housing," Sprague said in a statement. "This need can be exacerbated as builders and developers continue to recover after overextending themselves nationally and increasing interest rates lessened people’s buying power. We could see 15-20% less inventory in 2023 as builders scale back their housing starts.""

Source: Austin Business Journal

Written by: Cody Baird

Published: January 23, 2023

Posted by Grossman & Jones Group on

Leave A Comment