Austin Business Journal reports, "there's more evidence that Austin's housing market is correcting itself after years of overheating.

The Austin Board of Realtors'latest housing market datafound that September saw 9,671 active listings on the market — the most since 9,909 in July 2011 — and total inventory hit 3.1 months for the first time since July 2017. Median home sales prices also dropped more than $25,000 from August, helping the city push back on what's widely considered the biggest threat to the economy: affordability.

Though 3.1 months of inventory isn’t enough to transform Austin into a buyer’s market, there are winds of change.

“Homebuyers have not had this much leverage and this many options in over a decade,” ABOR President Cord Shiflet said in a statement. “We’re still in a seller’s market, but as homes take longer to sell and are being bought for less than the original list price on average, and with inventory steadily increasing, right now is a great time to be a homebuyer in Central Texas.”

A typical balanced housing market will have six months of inventory, Shiflet said.

Shiflet said one cause for the increase in inventory in recent months is the slowing migration from West Coast states that ramped up during the Covid-19 pandemic.

“What I’ve been trying to tell people is that a wave came,” he said. “We had all those buyers flood in, and that wave hit and now we’re kind of calming down a little bit more.”

As that flood slows down, homes are staying on the market longer — an average of 40 days, per the latest numbers, up 23 days year-over-year — and buoying the months of inventory.

“Homebuyers no longer need to move at a frantic pace to find a home,” Shiflet said. “There are more homes to choose from and more time to find a home that works for their needs and budget.”

Shiflet added that rising interest rates are giving buyers “sticker shock,” and that it could take until March of next year for buyers to get used to new rates. Many Realtors are pointing out to clients that they may be able to refinance at a lower rate in coming years.

Homes staying on the market for an average of 40 days is still an indicator of a seller’s market. As recently as 2019, Realtors would tell sellers their home would sell in three-six months, Shiflet said.

“It’s taking 30 days, 45 days to sell your house,” he said. “But think back three, four or five years ago, everyone would have killed for that.”

Those extra days on the market are helping buyers purchase homes at slightly below listing prices. Homes are selling at about 95% of their original list price, Shiflet said. The median sales price of homes in the metro during the month of September was $470,000, up 5% year-over-year but down from the record-high $550,000 of April and May.

“It’s the first time in years we have seen a good opportunity for buyers to not be competing and paying way over asking price, being one of 40 offers hoping they take it,” he said. “It’s a great time to be a buyer and not experience that pressure, and it’s still a great time to get to be a seller and be able to take a good cash-out on your house.”

While Central Texas' home inventory is increasing steadily each month, it’s still far from the levels needed for a balanced market.

“Austin, along with the other Texas metropolitan areas, may continue to feel the effects of the previously unsustainable housing market due to the lack of inventory,” said Mark Sprague, state director of information capital at Independence Title, when ABOR’s August market data was released. “We are just now getting up to three months of housing inventory, which is still short of the six to 6.5 months of inventory needed to be considered a healthy market.”

As more companies and jobs come to the Austin metro, Austin will struggle to support the number of people migrating to the area in the coming five years, Sprague said.

“The cost of developing and building homes in Austin continues to escalate with little to no relief,” he said. “This will cause sales to slow, as we see currently with home prices dropping and selling closer to the list price when compared to the past two years.”

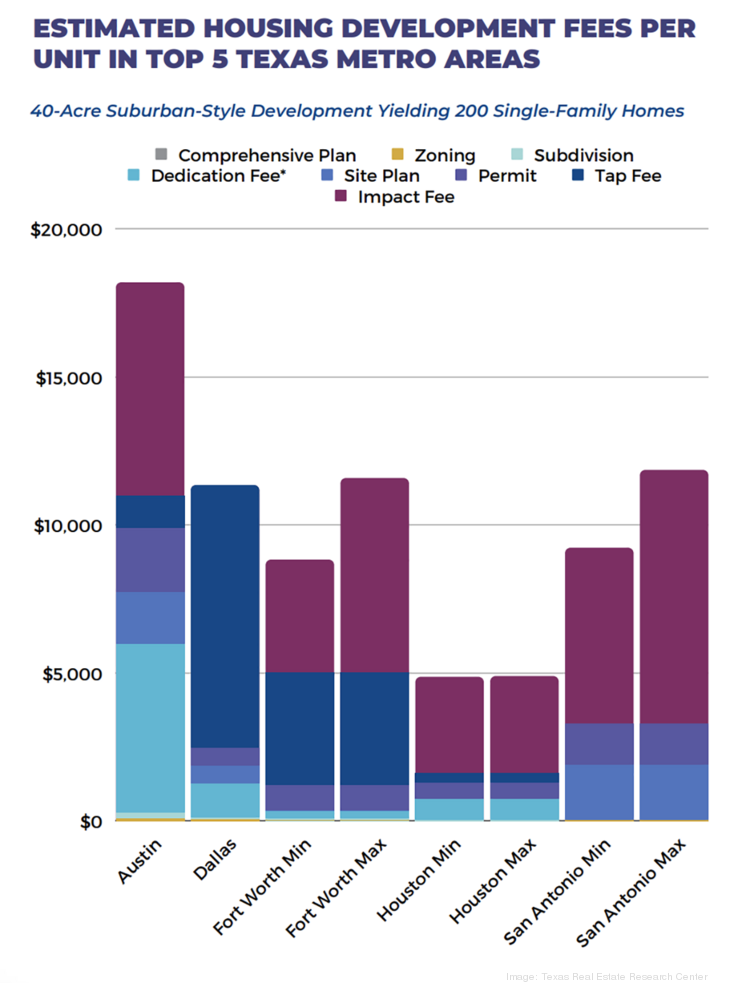

Development fees in Austin are drastically higher than other cities in Texas, according to a July report from the Texas Real Estate Research Center at Texas A&M University.

According to that study, the average development fees for a suburban-style subdivision in Austin were $18,168 per home, while the next-highest metro, San Antonio, had development fees of only $11,830 per home. Smaller infill housing developments showed similar results.

Elected officials and policymakers should prioritize housing for both current and future residents, Shiflet said in a September statement.

“While we are watching market conditions normalize, local leaders can’t take their eyes off the ball,” he stated. “Housing is still the most important issue facing our community today, and tomorrow. When it comes to development fees, Austin is 187% more expensive than other cities in Texas … That must change. Our city needs to take action and make meaningful impacts immediately.”"

Source: Austin Business Journal

Written by: Cody Baird

Published: October 17, 2022

Leave A Comment